Hiring An Independent Contractor? Your Tax Obligations

First time hiring an independent contractor? Here’s what you need to know about taxes.

Two months ago in this column, we explained the differences between employees and independent contractors. The IRS has strict rules that you must follow when you make this distinction because there are very different tax rules for each type of worker.

If you’re hiring an independent contractor for the first time, here’s the good news: Your income tax obligations are much simpler than they’d be if you were bringing on a new employee. You are not responsible for withholding and submitting payroll taxes to the IRS and state agencies. You simply pay the compensation that you and your worker have negotiated.

Here’s a look at the forms you and your independent contractor will need to complete.

The W-9

Independent contractors must complete a W-9 before they can get paid by you.

Where employees have to fill out a Form W-4 form to get paid by their employers, independent contractors are required to enter tax-related data on a Form W-9. This is a very simple document, requiring only the taxpayer’s:

- Name, address, and business name (if different).

- Business entity type (sole proprietor, partnership, LLC, etc.).

- Taxpayer Identification Number (TIN). This will most likely be your contractor’s social security number, though in rare cases, it may be an employer identification number (EIN).

- Signature and date signed.

You or your independent contractor can print out a copy of the W-9 here. He or she can either send you a completed paper copy or scan it and email it to you. As the employer, you’ll use this information to report your independent contractor’s annual income. The IRS advises you to keep this form for four years in case it has questions at a later time.

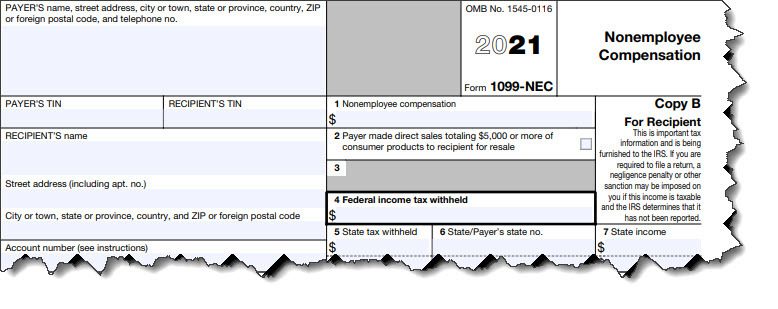

Form 1099-NEC

Before tax year 2020, nonemployee compensation was reported in Box 7 of the Form 1099-MISC. Now, though, there is a separate form for it: the Form 1099-NEC. If you paid someone who is not your employee $600 or more during the tax year, you must complete this form. You’ll need to submit one copy to the IRS, one to state taxing agencies, and one to the contractor by January 31 of the year following the year the income was earned.

You’ll need several copies of the 1099-NEC for distribution.

In addition to the taxpayer’s name, address, and TIN, and your TIN (account number is optional), you must include the following information on the Form 1099-NEC:

- Box 1 should contain the total that you paid the independent contractor during the tax year (nonemployee compensation)

- If the Box 2 is checked, it signifies that you sold $5,000 or more in consumer products to the contractor for resale, on a buy-sell, a deposit-commission, or other basis. The contractor should report income from these sales on the Form 1040’s Schedule C.

- Box 3 is not currently being used by the IRS.

- If you withheld federal income tax from the contractor’s payments, as is required when he or she does not supply a TIN, you must report it in Box 4.

- Boxes 5-7 would only be used if you withheld state income tax.

You can see an example of the Form 1099-NEC here, but you can’t just print or scan and email all of the copies needed. Copy A goes to the IRS, and the other copies go to state tax departments and the independent contractor. You must have an official IRS version of Copy A because it needs to be scanned by the agency. The other copies can be downloaded and printed.

The Form 1099-NECs that you send to the IRS must be accompanied by Form 1096, Annual Summary and Transmittal of U.S. Information Returns. We’ll tell you more about acquiring and preparing all of these forms as the deadline for the 2021 tax year gets closer.

Your relationship with your independent contractor should be fairly uncomplicated where taxes are concerned. But if you’re dealing with a situation that causes you to question your handling of it, please let us help. We can also advise you on your classification of your new hire (independent contractor vs. employee), a distinction that the IRS takes very seriously. As always, we’re available to help with year-round tax planning and eventual preparation and filing.

SOCIAL MEDIA POSTS

Hiring an independent contractor for the first time? We can help ensure that you’re handling related tax issues correctly.

Are you sure that the individual you’re hiring is an independent contractor and not an employee? We can help you sort it out.

Two IRS forms must be completed when you hire an independent contractor: the Form W-9 and the Form 1099-NEC.

Did you know that nonemployee compensation is no longer reported on the Form 1099-MISC? The Form 1099-NEC is used now.