How to Protect Yourself from Tax Identity Theft

It can happen online or offline. Are you taking steps to protect your identity?

As you work on your 2021 income tax returns, the IRS is still catching up from the 2020 tax year. Because of the COVID-19 pandemic and the problems it caused for all kinds of businesses and government agencies, there are reports that some individuals still haven’t received their refunds that they filed for in 2021.

In a “normal” year, that kind of delay would be cause for alarm, because there’s another reason why tax refunds can be late. It’s possible that someone obtained your Social Security number, filed a fraudulent return, and deposited your refund money.

If that were to occur, you’d eventually get a letter from the IRS stating that your Social Security number was used to file a return that came in earlier. Other types of communications might alert you. So if you haven’t received your 2020 refund yet and haven’t received any suspicious messages, it’s more likely that it’s just delayed. But there are steps you can take to help avoid tax identity theft.

Take Precautions Online

You’ve probably heard about one of the scams that’s been going around. You get a phone call or an email stating that you’re seriously in arrears with your taxes and could even go to prison if you don’t pay up. You’re sometimes told that you need to purchase gift cards and read the numbers over the phone to settle your debt (which should be your first clue).

The IRS does not do this. They don’t make initial contact via email or phone calls. They send letters. So never respond to such a request. You can report such activity here, or send an email to phishing@irs.gov.

You can report fraudulent tax activity on this Treasury Department website.

Never click on a link in an attachment or provide sensitive personal information online or over the phone unless you initiated the interaction. Scammers have gotten very good at creating emails that look legitimate, even from the IRS. They’re also very good at convincing people that they’ll be in some kind of trouble if they don’t do what they’re asked.

There are other things you can do that seem like common sense, but many people don’t do them. That’s why hackers obtain many billions of dollars from individuals and businesses every year. So we recommend you:

- File early. Don’t give someone a chance to beat you to it.

- Adjust your withholding so you don’t get a large refund.

- Check out the security measures practiced by online tax preparation sites before you use them.

- Get an Identity Protection PIN, a 6-digit code issued by the IRS..

- Practice good computer hygiene. You know the drill. Create strong passwords. Use online security software. Subscribe to a reputable service that offers identity theft monitoring. Keep your computers and mobile phone updated. Use multi-factor authentication (MFA) when it’s offered.

Be Careful Offline, Too

The internet is not the only place your Social Security number and tax-related information live. There are risks in the real world, too.

Don’t carry your Social Security card—or anything with your Social Security number on it—in your wallet or purse. If you absolutely must supply your number to anyone but the IRS, make sure you know how it will be used and stored. Take outgoing mail to a USPS box or post office, and don’t leave incoming mail in your mailbox for any longer than you have to. If you’re ever around other people when you’re working on your taxes, like in a coffee shop or library, be aware of your surroundings so no one can look over your shoulder.

And shred all financial papers that you don’t need anymore. Always shred.

Dealing with the Aftermath

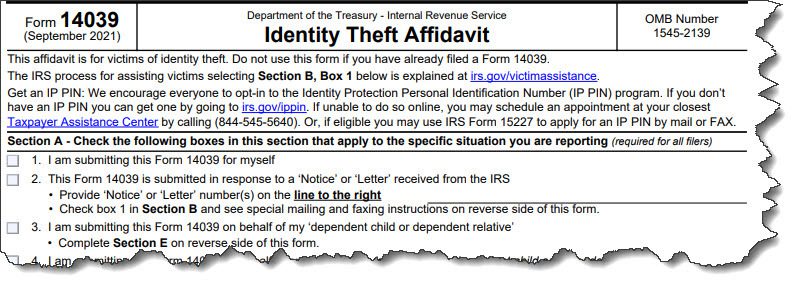

If someone has used your Social Security number to file a fraudulent return, you may need to complete and submit an IRS Form 14039.

If the worst happens and you find that someone has absconded with your refund, there are several steps you should take, including:

- Answering the IRS’ letter immediately. Call the phone number provided.

- Completing an IRS Form 14039.

- Getting in touch with law enforcement. What the thief did was a crime.

- Reporting the fraud on a specialized FTC website.

- Having a fraud alert placed on your credit records. Contact Equifax, Experian, and TransUnion. If the person who did this to you used your Social Security number with the IRS, he or she may have also tried to, for example, apply for credit cards in your name.

- Making your bank(s) aware of the situation.

You can also contact us. We want to know if your tax information has been compromised. We can help you plan for income taxes year-round so that when the filing season opens, you’ll be ready to file early. That’s a wise practice whether or not you’ve been the victim of identity theft.

SOCIAL MEDIA POSTS

If you file your income taxes early, you’re less likely to be a victim of tax identity theft and lose your refund.

Do you know what to do if you’ve been the victim of tax identity theft? We can walk you through the steps you should take.

The IRS will never make an initial contact through email or phone calls. Beware of income tax scams this time of year.

How can you tell if you’ve been a victim of tax identity theft? We can tell you about the warning signs and help you through it.