Should You Claim the Home Office Deduction?

It can reduce your income tax obligation, but be sure you understand the IRS’s rules.

One of the many ways the internet has changed business over the last two decades is the increasing numbers of part-time entrepreneurs. Simple do-it-yourself website design tools have made it possible for anyone to create a virtual storefront that looks impressive — even if its CEO is working out of his or her spare bedroom.

At the same time — whether it’s good or bad — businesspeople have found it easier to do office work at home.

At the same time — whether it’s good or bad — businesspeople have found it easier to do office work at home.

If you’re in one of these two situations, you may be able to take the Home Office Deduction on your IRS Form 1040. There are two primary requirements:

- You have to use your home office space exclusively for business.

- The area of your home that you’re claiming must be used as your “principal place of business.”

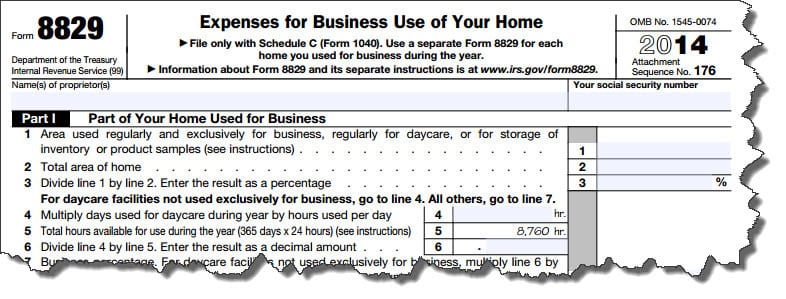

Prior to the 2013 tax year, doing the required calculations to determine the costs associated with the business use of a portion of your home was quite complicated. It can be a less complex task now, if you use what’s called the Simplified Option. However, you can still claim the Home Office Deduction using the Regular Method.

Warning: Once you select one of these options for a given tax year, you must stick with it through that year. If you change from the Simplified Option one year to the Regular Method the next, you’ll need to know how to handle depreciation. We can help with this.

Here are some of the specifics. Where you used to have to maintain records of actual, legitimate expenses (and you still can, using the Regular Method), you now have the option to take a standard deduction of $5/square foot (maximum 300 square feet) for the section of your home that you’re claiming.

Filing can be less time-consuming, too, using the Simplified Option. In previous years, you had to enter some home-related itemized deductions on the Schedule A and the rest on Schedules C or F. You can still do so using the Regular Method. But now you can claim them in total on the Schedule A.

Do you want to work with depreciation for your Home Office Deduction? If so, you’ll have to stick with the Regular Method. Using it, you can:

- Take a depreciation deduction for the area of your home that you use for business, and

- Recapture that depreciation when you sell your home.

Figure 1: The Simplified Option makes it easier to file for the Home Office Deduction, but it may not be best for your situation. We can help you sort it out.

If you’ve decided that you want to use the Simplified Option, there’s no depreciation deduction, and, of course, no recapture of it.

Loss carryover is affected, too. Using the Simplified Option, you cannot:

- Carry over any amount that exceeds your gross income limitation, or

- Claim a loss carryover that was derived from the use of the Regular Method in the previous year.

One thing that’s stayed the same in both is this: the Home Office Deduction can’t be higher than the gross income you’re declaring from the business use of your home minus business expenses.

Obviously, determining what the amount of your home office deduction will be is still a complex operation, even though the new rules are called the Simplified Option. We can’t recommend that you attempt either alternative without consulting with us. It may or may not be an effective way to lower your tax obligation, and you might spend hours trying to figure this out on your own. So let us help.