Tax Planning, 12 Months a Year

We’re halfway through 2016. What do you know about this year’s income tax obligation?

Your 2016 income taxes are probably not at the top of your mind in the middle of summer. After all, it seems like you just filed your 2015 taxes (or you put in for an extension). Maybe you made your two estimated tax payments that have been due so far this year, but that’s as close as you’ve come to thinking about IRS forms and schedules.

The way we look at it, this is an ideal time to start your 2016 tax planning. In fact, we’d suggest you start even earlier in the year. You’ve already recorded a solid six months of income and expenses, which is more than enough information to start getting a picture of where you stand with your income taxes.

An aside here: If you’re still doing your accounting manually, it probably takes you a good deal of time and effort to pull together reports of your financial status. We strongly urge you to consider a cloud-based accounting application. There are many to choose from, and we can help you find one that’s a good fit for your company. You’ll quickly wonder why you didn’t make the move sooner.

Just as they make your overall financial planning easier, faster, and more accurate, cloud-based accounting applications can help tremendously with tax planning. We can help you find the right match.

Building a Schedule

Tax planning is another element of your overall financial planning. You can’t separate the two. Just as you work constantly toward keeping revenue ahead of expenses, you need to know how those sales and purchases will affect your income tax obligation.

There are times throughout the year when you’ll need to make a decision based in part on the outcome’s impact on your income taxes, such as major acquisitions of property, equipment, vehicles, technology, etc. Should you purchase outright or consider renting or leasing? You should know ahead of time how you’ll be reporting these on your taxes. We can help with these decisions.

We also suggest putting yourself on a tax planning schedule – a set of steps you take throughout the year that will put you ahead of the game when it comes time to file. That way, you avoid an unpleasant surprise. Instead, you’ll have a pretty good idea of where you stand before the IRS finalizes its forms and schedules in mid-January.

So here’s what we’d suggest for the formal part of your tax planning:

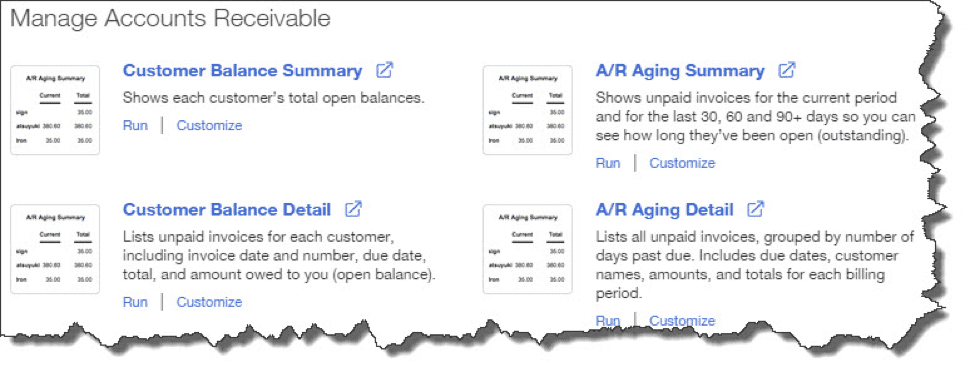

Every month. Create basic accounts payable and receivable reports. If you’re using an accounting website, you can do this in seconds. If you you’re doing manual bookkeeping, you really need to have a system in place so that end-of-month reports can be assembled without hours of combing through files. Compare revenue with expenses to see where you are, and compare the results to last month’s and last quarter’s. How are you doing with your budget?

Every quarter. There’s a handful of reports that you should be running and analyzing at least every three months, if not monthly, like Trial Balance, Profit and Loss, and Statement of Cash Flows. These are advanced reports whose results are difficult to interpret unless you’re an accountant. Let us help you with this.

You’ll also need to be prepared to pay your estimated taxes. Some businesses don’t do this because it’s too difficult to calculate. This means they end up having to pay penalties on top of a big tax bill at filing time. Don’t let this happen to you.

November and December. There are numerous tax-related issues that you’ll need to consider when the year’s end approaches. Are your accounts receivable terribly in arrears? Will all of your bills be paid? Do you need to make charitable donations, purchase items, etc., that will offset your revenue? Do you need to defer some income?

These are complex issues that we’d like to go over with you during the last couple months of the year.

Income tax preparation can be complicated, frustrating, and time-consuming. Planning for it throughout the year will definitely lighten your load when it’s time to file.

Stock images courtesy of FreeDigitalPhotos.net