Using a Vehicle for Business: Q&A

IRS rules and exceptions abound, but there are some questions we can answer simply.

Next to your home, your car is probably the most expensive investment you make. And the costs of paying for and maintaining it can be considerable. Can you recoup some of your investment by claiming vehicle expenses on your tax return?

Sometimes. The IRS has many restrictions on the business use of a vehicle, and those restrictions have many exceptions. Better to know these upfront than to have to correct a tax return after you’ve filed it. Here are some questions and answers that may help you decide whether you’re eligible.

How does the IRS identify a “vehicle”?

How does the IRS identify a “vehicle”?

A car, van, pickup, or panel truck.

What are transportation expenses?

These are “ordinary and necessary expenses” incurred when you, for example:

- Visit customers,

- Attend a business meeting held at a location other than your regular workplace, or

- Go from home to a temporary workplace that is not your company’s principal location.

The daily commute to and from your regular office is not deductible. The IRS considers this personal commuting expenses.

What if I’m on an overnight business trip away from home?

The IRS considers these travel expenses, and they’re reported differently. Your car expense deduction, though, is calculated the same way in both situations.

What if I use my car for both business and personal purposes?

You’ll calculate the expenses incurred for each by determining how many miles you drive for business and how many you drive for personal reasons.

You’ll calculate the expenses incurred for each by determining how many miles you drive for business and how many you drive for personal reasons.

I work in a home office. Can I deduct any driving expenses?

Yes, you can deduct the cost of driving to “another work location in the same trade or business.”

How do I calculate my deductible expenses?

There are two options. Using the standard mileage rate, you can claim 57.5 cents per mile (2015 tax year figure). You are required to use this method for the first year you use the vehicle for business purposes. After that initial year, you can choose between the standard mileage rate and actual car expenses. These include depreciation, oil and gas, insurance, and repairs.

Depreciation? Isn’t that difficult to calculate?

Yes, especially for cars. If you plan to take this kind of deduction, please let us handle your tax preparation for you. Depreciation is very, very complex, and sometimes requires more than one calculation method.

Can I take a Section 179 deduction for my vehicle?

Possibly, if you use the car for business more than 50 percent of the time — and only for the first year.

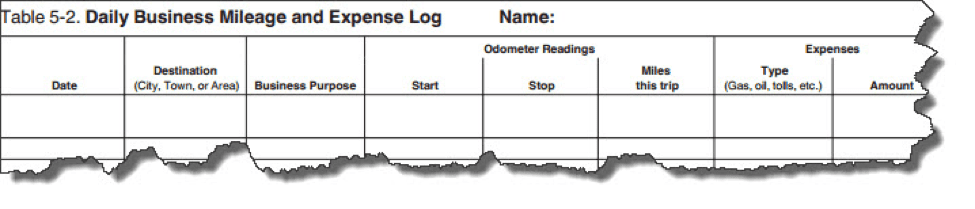

What kind of vehicle expense records do I need to maintain?

You know the drill here. If the IRS ever wants to examine your return, it will expect evidence like receipts, cancelled checks, and credit card statements. You’ll need to document the date and location where you incurred the expense. You’ll need accurate mileage records (miles driven, purpose of trip, etc.).

These requirements scream for some kind of organized computer log or written diary, along with a safe place for any paper receipts, bills, etc. There are numerous mobile apps that can help you with this task. We can steer you in the right direction.

If you’re planning to deduct car expenses, it’s important that you keep careful paper or electronic records.

Where will I be reporting transportation expenses?

If you are self-employed, you will report business-related vehicle expenses on Schedule C or Schedule C-EZ (Form 1040). Farmers should use Schedule F (Form 1040). You’ll also want to complete a Form 4562, which is used to report depreciation and the Section 179 deduction.

Maintaining accurate records for car and truck expenses is time consuming and detail intensive. And that’s once you understand all of the IRS’s rules and exceptions surrounding this deduction. To avoid having to fix completed tax documents that the IRS has questioned, talk to us before you put a vehicle into business use. We’ll be happy to evaluate your transportation situation and guide you through the process.

Stock images courtesy of FreeDigitalPhotos.net